The First Rule Of Making A Personal Budget - Keep It Simple

Rules. Nobody likes rules. Be that as it may, we as a whole understand that on the off chance that we didn't observe traffic rules and stop at a red light, our avenues would be confusion. On the off chance that you need to have an effective individual spending plan, you need to adhere to the principles (for this situation one straightforward standard).

Numerous individuals accept that there are a ton of rules to follow when making an individual spending plan. Individuals trust you should deal with your financial limit each day, and monitor each penny you spend, or else your financial limit won't work. A great many people think spending plans are a ton of work.

The vast majority likewise accept that spending limits are hard. They think you should be a bookkeeper to have the option to make and keep up an individual spending plan.

Spending plans can be a ton of work, yet they don't should be, on the off chance that you adhere to the First Rule of Making a Personal Budget: Keep it Simple. Indeed, similar to a great deal of things throughout everyday life, the KISS rule applies to your own financial limit.

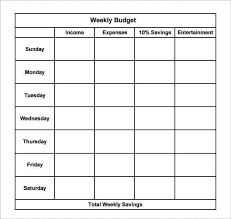

Try not to attempt to make a confounded arrangement of connected spreadsheets with extravagant diagrams and tables. Try not to attempt to ace the most confused individual planning programming. Try not to accept that you need to go to class and study accounting and bookkeeping to make your spending work for you. Keep it straightforward.

Start with a clear bit of paper, or a clear spreadsheet, and cause a rundown of what you to go through cash on consistently. Truth is stranger than fiction, you are not making a spending limit; you are making a rundown - how simple is that?

The vast majority can't cause a rundown of what they to go through every month, since they have no clue what they spend their cash on. Forget about it. Keep it basic. Get a pencil and a bit of paper, and convey them with you all over the place. At whatever point you go through cash, write in down. Toward the finish of a typical week, you will have a smart thought of where you go through your cash.

You could then take your week of notes and make a month to month spending plan. Be that as it may, to cause your financial limit considerably less difficult, to do a different spending plan for each check, or make a different segment on your spreadsheet for each check. That implies on the off chance that you get paid each week, have a section for consistently.

At that point, make an arrangement for how you will spend each check. It's a lot more straightforward to conclude how to go through your check this week than it is to attempt to spending plan for the following a half year.

Peruse that sentence once more: make an arrangement for how you will go through your cash. That is the main explanation behind making a spending limit. By monitoring where your cash goes, you can profit where you need to spend it.

Numerous individuals accept that there are a ton of rules to follow when making an individual spending plan. Individuals trust you should deal with your financial limit each day, and monitor each penny you spend, or else your financial limit won't work. A great many people think spending plans are a ton of work.

The vast majority likewise accept that spending limits are hard. They think you should be a bookkeeper to have the option to make and keep up an individual spending plan.

Spending plans can be a ton of work, yet they don't should be, on the off chance that you adhere to the First Rule of Making a Personal Budget: Keep it Simple. Indeed, similar to a great deal of things throughout everyday life, the KISS rule applies to your own financial limit.

Try not to attempt to make a confounded arrangement of connected spreadsheets with extravagant diagrams and tables. Try not to attempt to ace the most confused individual planning programming. Try not to accept that you need to go to class and study accounting and bookkeeping to make your spending work for you. Keep it straightforward.

Start with a clear bit of paper, or a clear spreadsheet, and cause a rundown of what you to go through cash on consistently. Truth is stranger than fiction, you are not making a spending limit; you are making a rundown - how simple is that?

The vast majority can't cause a rundown of what they to go through every month, since they have no clue what they spend their cash on. Forget about it. Keep it basic. Get a pencil and a bit of paper, and convey them with you all over the place. At whatever point you go through cash, write in down. Toward the finish of a typical week, you will have a smart thought of where you go through your cash.

You could then take your week of notes and make a month to month spending plan. Be that as it may, to cause your financial limit considerably less difficult, to do a different spending plan for each check, or make a different segment on your spreadsheet for each check. That implies on the off chance that you get paid each week, have a section for consistently.

At that point, make an arrangement for how you will spend each check. It's a lot more straightforward to conclude how to go through your check this week than it is to attempt to spending plan for the following a half year.

Peruse that sentence once more: make an arrangement for how you will go through your cash. That is the main explanation behind making a spending limit. By monitoring where your cash goes, you can profit where you need to spend it.

Comments

Post a Comment